A Two-Pronged Approach

Long the industry standard for identifying volunteers for clinical trials, paid media campaigns for patient recruitment have never made patient identification more wide-reaching and convenient.

While the scope of social media and traditional advertising can quickly generate awareness of thousands of motivated, potential patient volunteers, the high cost-per-enrollment and low enrollment rate of media respondents can often spell trouble when site-based recruitment techniques are not considered as part of a holistic strategy.

A truly optimized recruitment plan requires balance. To maximize the ROI of your patient recruitment, it’s time to invest in site-based tactics.

Unlocking the ROI Potential of Patient Recruitment

Sponsors typically view patient recruitment as an expense. When they do, it becomes a self-fulfilling prophecy.

They are making a costly mistake.

A patient recruitment program should be an investment, with a measurable ROI.

Think about it this way: A well-designed and executed patient recruitment program will produce a definitive number of enrollments. Those enrollments can be translated into study time saved, which can be monetized into a specific dollar amount.

You can calculate ROI in two ways:

- The actual savings on the fixed costs associated with running the study. If six months can be cut from the enrollment period, then that’s six fewer months of having to fund the study’s fixed expense portion.

- Incremental revenue opportunities that arise from earlier market entry.

We’re going to focus on the former, which starts with the concentric circle model of recruiting.

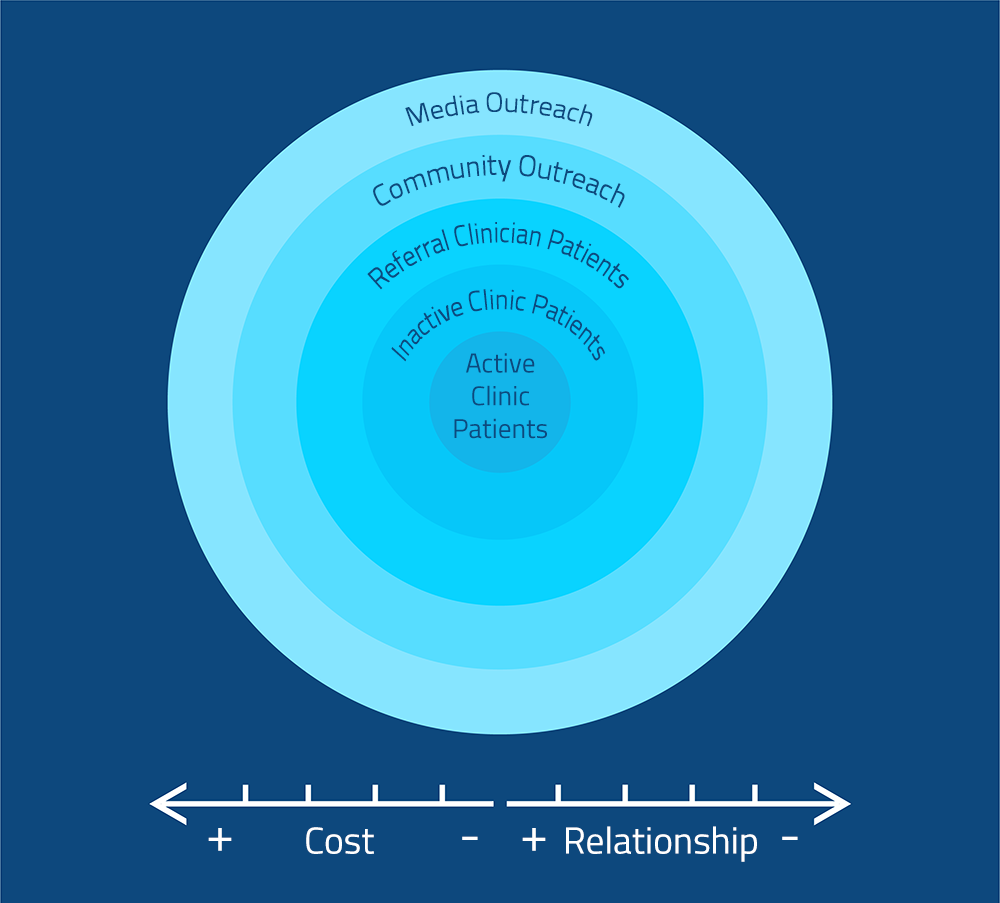

Concentric Circles

While every therapeutic area and study site will be different, for this example we will examine the benefits of starting at innermost circle and working our way out through successive circles.

Let’s start with the three inner circles, which include “known patients” who are connected to the site. They are, by far, are the lowest cost-to-enroll candidates for a trial.

The inner circle contains active clinic patients, which are patients on the daily appointment schedule at the site. The next ring contains inactive patients, who are not on the daily schedule but have a medical record at the site. The third includes patients who have a relationship with one of the site’s regular referral practices.

The two outer rings contain “unknown patients” with no connection to the site. These rings will yield a far bigger and motivated patient pool, but likely a very small percentage of eligible participants.

The fourth ring includes those who can be tapped via community outreach efforts. The outermost ring contains the rest of the universe–generally recruited through media outreach. (This is where most recruitment firms solely focus their efforts.)

Most patient recruitment efforts start at the outermost circle, with media outreach. But many of them never get much beyond community outreach.

So, why don’t they move into more targeted site-based recruitment? It’s not the site’s fault; most simply lack the on-staff capacity. Site-based tactics require additional onsite support to conduct chart reviews and target and contact patients.

Instead, sites typically start at the outer rings of the concentric circle, casting a wide net for patient targeting. Considering how few people end up enrolled from this methodology, it can end up a very a costly and inefficient process.

As figure 1 shows, two key factors affect ROI:

- Cost per patient: This is the total cost for executing recruitment in a specific ring divided by the number of enrollments produced. The cost per patient will be lowest in the innermost ring for those active clinic patients. As you move outward, the costs grow per enrolled patient.

- The relationship between the patient and the investigator/site: The relationship is going to be strongest in that innermost circle. Where the relationship with the site or investigator is strong, patients are more likely to enroll.

Next, you need to estimate how many recruits each circle will yield.

Developing a forecast

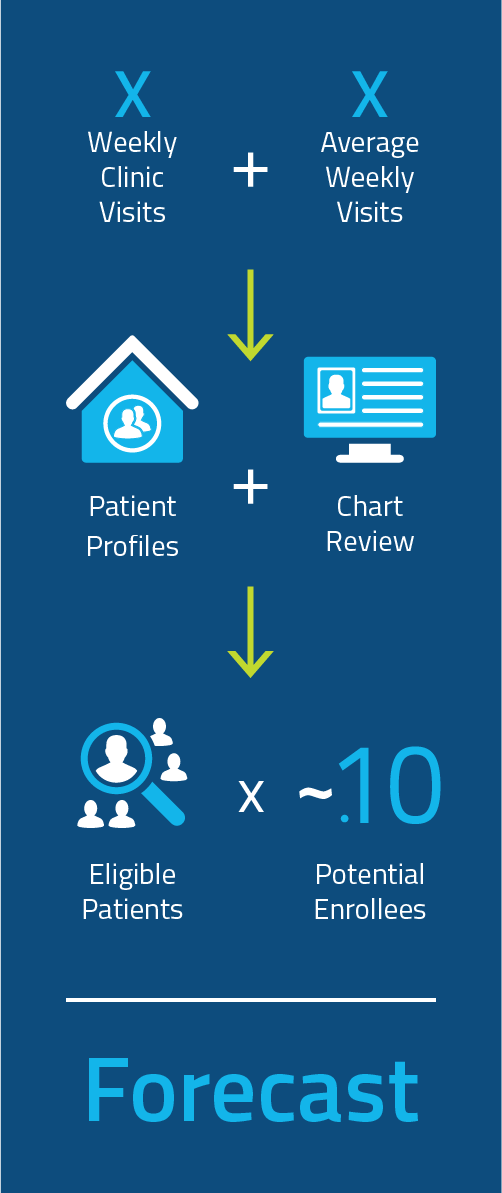

Again, let’s start with the inner circle: How do we develop a forecast for active clinic patients?

- Summarize weekly clinic visits by surveying sites and determining each one’s average number of weekly visits, then add the numbers together.

- Using protocol criteria, survey the profiles of each site’s patients during site selection:

- Do a chart review. You can create a query using high-level IE criteria that can be tied to codes, such as procedure codes, diagnostic codes, lab codes, drug prescriptions and so on.

- Use that survey to identify a percentage of patients who meet study eligibility.

- Estimate the percentage that will actually enroll. (No matter how optimistic you are, that estimate should not exceed .)

Let’s walk through an example:

- If we estimate 100 visits per week at each site, multiplied by 50 sites in a study, we end up with 5,000 visits per week.

- If an estimated 10% of those patients meet the study eligibility, you have 500 eligible patients per week.

- If 5% of that number of patients enroll, you have 25 enrollments per week.

Use the same process for inactive patients.

As you move into the third circle, you will need to know about the referring physicians. Which ones refer the most? (See sidebar on tips for maximizing referrals.)

To do this systematically for each circle and each study, you need a process in place. We outline one in the accompanying sidebar.

Do the math

Once you do a forecast for each circle, you’ll see why it’s important to consider a holistic approach to patient recruitment.

Example:

Media: Average cost-per-patient recruited = ~$20,000

Site-based: Average cost-per-patient = ~$3,500

Study A: Used media to recruit all 250 patients needed for a study.

250 x $20,000 = $5,000,000 for patient recruitment

Study B: Started with Site-based programs and enrolled 150 patients– needing only 100 patients through media recruitment.

150 x $3,500 = $525,000

100 x $20,000 = $2,000,000

$525,000 + $2,000,000 = $2,525,000

Cost savings

Study A = $5,000,000 for recruitment

Study B = $2,525,000 for recruitment

$2,475,000 saved

Studies A and B ended up recruiting the same number of patients–250. However, the cost of getting there was quite different. And keep in mind that’s not the only metric: You’ll also want to account for how much time it would take to enroll those 150 patients from site-based recruitment compared to those 100 patients via media outreach.

Make it So: Put a Process in Place

To optimize this model, develop a systematic process and workflow for each circle. For example, looking at the innermost circle, you cannot assume investigators will proactively identify every eligible patient for the study. That’s why you need a process in place.

For each circle:

- Map out a systematic process and a create a detailed workflow.

- Determine who will do the work.

- Estimate patient candidates over defined time periods from each circle.

- Use a central tracking system to capture data for each tactic and site.

- Regularly review data, take corrective actions where needed and update enrollment forecast using real-time data.

Once you’ve done this for every circle

- Use enrollment numbers produced by each to calculate saved study-enrollment time.

- Calculate the monetary value of the time saved.

This is relatively straightforward process; once you’ve done it a few times, it will become intuitive. You can test it out with past trials to get a feel for it, or you can jump right in and use it for your next study. If you need help getting started, we’re here to provide guidance –at no charge. Just contact us at info@wcgclinical.com.

Sidebar

Maximizing That Third Circle: Referrals

There’s a misconception that physicians don’t want to refer patients to clinical trials out of fear that they’ll lose that patient. Yes, it’s true in some cases but not nearly to the degree that it’s assumed. The Center for Information and Study on Clinical Research Participation, among others, has soundly debunked that myth.

So how do you motivate a physician to refer a patient to a clinical trial? Here’s what doesn’t work: Sending letters, sending postcards, sending tchotchkes. Inviting physicians to dinner and giving a presentation doesn’t work well, either.

Instead, physicians need to know about the patient population sought and have enough information about the study so they can feel comfortable referring their patients.

To make this work, someone from the site needs make contact and physically visit the physician’s office, introduce themselves and establish a relationship. Going to that physician’s practice, establishing that relationship, understanding the lay of the land and then keeping that message consistently in front of the people who determine where to refer patients–that’s the key to success.

Find out how many months our Participant Enrollment services can cut from your enrollment timelines

Complete the form to schedule a consultation with WCG. We’ll share benchmark data, analyze your results, and share some of the common practices of top performers.