There must be a better way.

The site selection and feasibility process shouldn’t be arduous, yet it continues to be a critical pain point across the clinical trial ecosystem, affecting sponsors, CROs, and investigational sites. It both difficult and inefficient.

Organizations keep looking for that silver bullet, but there isn’t one. Improving site feasibility is a complex challenge that demands a comprehensive solution.

A Broken Status Quo

Sponsors are stuck: The cycle times associated with study startup, including site identification and activation, have changed little over the past 20 years. Costs, however, have not remained static.

The cost of bringing a drug to market has increased 82% going from $1 billion to almost $2 billion over the past decade. Moreover, the internal rate of return for taking a new drug product to market has dropped precipitously. It was roughly 10.5% in 2010. In 2019, the return on investment for that same new drug product would have been 1.8%.¹

Investigational sites have their own problems. Information from the Tufts Center for the Study of Drug Development and WCG’s Knowledge Base, reveal that 37% of sites selected for clinical trial studies under-enroll compared to their original forecast. Even though 89% of studies meet enrollment goals, sponsors are often forced to extend—even double—the original timeline due to poor enrollment. And, as we all know, roughly 11% of sites fail to enroll a single participant in a trial.

The entire process is time consuming. It takes nearly 60 days for sites to be notified that

they’ve been selected for a trial after completing a site feasibility survey, and it takes an estimated eight months to move from site qualification visit to site initiation visit.

An Inefficient Process

How did we end up here? Too often, each study is treated as a new engagement, and most organizations follow a similar inefficient process:

- The sponsor develops the new study concept/protocol hands it over to operations to execute.

- The study team is identified. Usually, it’s a brand-new team working together for the very first time.

- The study team develops a high-level project timeline with little information on which to base that timeline. Worse yet, the timeline handed down by someone in senior leadership is completely unrealistic with no basis in reality.

- They kick off study planning and study start-up activities (e.g., global regulatory submissions, investigational product planning, and initial pre-study activities).

- Site identification and feasibility efforts begin. The sponsor’s internal team may manage this, or it may be outsourced to a partner, such as a CRO.

- Finally, the study team pulls together its ideal site profile and hands this over to the team, which has been searching, with limited information, for qualified candidates.

Given the inefficiency of this process, it’s no surprise that we hear complaints like this from investigational sites: “Every time I engage with a new study, even for an existing sponsor, it’s like I’m working with a new team – the rules keep changing every time.”

Sites frequently don’t have enough information about the protocol to adequately fill out the feasibility survey; even worse, their contacts on the sponsor or CRO study team often cannot answer their questions. “Team members are calling us who are not familiar with the study. They can’t even pronounce the names of the drugs or answer relatively simple questions about the protocol procedures or expected patient requirements.”

Sites are frustrated. They cannot get access to new sponsor customers. They cannot figure out how they are being scored on answers they provided in the feasibility assessment. They have many questions no one seems able to answer completely, yet they are being asked to sign up for a study and perform well.

The opportunity for improvement is tremendous.

To Understand Failure, Know What Success Looks Like

The actual concept of site identification is not that difficult. As an industry, we know what needs to be achieved, so why aren’t we doing it? Why do we frequently fail at feasibility?

To answer those questions, let’s look at where we often succeed in site identification:

- Repeatability: We’ve done the same kinds of trials over and over again in the same clinical indication. We learn from the first and apply the lessons to the second, third and so on.

- Reproducibility: We know what to expect and we can anticipate those problems and get ahead of them with more predictable outcomes.

- Familiarity: We know who the players are in the space, and the players know the drill; they know the compounds, the processes and the companies.

- Quid pro quo: This boils down to “We are going to provide something, and they are going to provide something in return.” Success requires commitment from all sides and a partnership between the sponsor and the site (and sometimes the CRO). If the sponsor provides useful information, a fair contract and budget, and a protocol that is easily understood, the sites will return the favor with good data and high-quality patients.

- Trustworthiness: Everyone involved must trust each other. This requires open, honest, timely and transparent communication across all parties in the trial ecosystem: Sponsors, CROs, sites and ultimately the patient participants.

Think about your current practices. Do you achieve all of these? Some of them? Does it depend on the therapeutic area or clinical indication? Some sites and sponsors do some of these well and others not well at all. Where does your organization fall

Sponsors and sites alike typically have considerable variability in how they approach

each new study opportunity. Most are far from having a robust process that is reproducible, repeatable and yields excellent outcomes.

That can change.

Where are You Today? Where do You Want to Be?

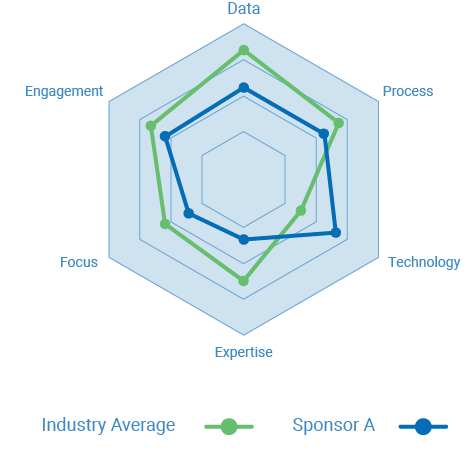

We’ve developed a model to help sponsors assess their levels of site identification maturity. This maturity model provides insights that help you in areas you are doing well and in those that need improvement by comparing where you are to where you are on the scale to where you aspire to be.

When navigating a maturity model, you typically rate a series of variables to describe

your current and aspirational states. Based on those scores, you’ll have a clear visualization of your gaps and can identify opportunities for improvement. Our scale ranges from level 1 (initiation) to level 5 (optimization). The figure below illustrates this model:

Maturity Model

Where are you today and where do you want to be?

Initiation

(“Ad Hoc”)

Developing

(“Emerging Discipline”)

Defined

(“Responsive”)

Managed

(“Proactive”)

Optimized

(“Advanced”)

We’ve identified six variables crucial to feasibility, and this model can be applied to each.

Variable 1: Data

During clinical trial start up, some teams have little or no data from which to work. Others have an overwhelming amount of data. Both struggle. Even when there’s a wealth of data available, many teams lack the expertise to use

it appropriately.

That’s because data is valuable only when translated into actionable insights. Data alone

is insufficient. Yet, according to a recent Forrester report, 74% of organizations say they want to be data driven, but only 29% are successful at connecting analytics to action.

Writer Andrew Lang captured this quite well: “He uses statistics as a drunken man uses lampposts—for support rather than illumination.”

Variable 2: Process

The way sponsors execute site feasibility has remained largely unchanged for years. For

most, it is just a series of tasks or events, with one completed before the next one starts.

The figure to the right illustrates the difference between traditional methods and an agile relationship-management approach to site identification. Sponsors are able to adopt an agile approach only when they know what their goals are and how they will make key decisions along the pathway.

This alternative approach involves four components:

Alternative Approach:

- Design a platform that includes a library of questionnaire templates and leverages historical information.

- Build deep site relationships and treat them like customers.

- Convert quickly. Act effectively. Provide good intel and context.

- Activate sooner. Have the system ready. Know in advance which sites you want and which you don’t.

Improved Results:

Within 24 hours, 110 high-performing investigators expressed interest in participating. By day 5, that number increased to 200.

Traditional Approach:

- Potential sites keyed into spreadsheet.

- Contact info is researched.

- Questionaire emailed to site.

- Blinded or Unblinded Survey.

- Responses received and reviewed.

- Series vs. parrallel process.

Traditional Results:

Median of 57 days between site contacted and site selected.

Variable 3: Technology and Automation

Technology must play a significant role in optimizing the site feasibility process. Specifically, we need technology that allows study teams to find, manage, and qualify the best set of investigators for a given trial in a short amount of time.

However, most clinical systems used for clinical trials begin managing the process only

after sites are selected, not during the identification process. Moreover, most organizations manage this through endless spreadsheets and trackers, and they do this on a study-by-study basis.

It takes technology and automation to improve the feasibility process and make it more

efficient. The technology platform needs to be simple, automated, portfolio-level, and easy to use, driving those insights for your team on this trial but also on other trials that will come along.

Variable 4: Focus

Study teams are often coming together for the first time just as the study startup activities begin to take off. Each new member brings a wealth of information and experience, but as a team, they are initially unfocused until they start to develop the standards and norms on how they will work together. This is extremely difficult to do, let alone do well during the study planning phase of a clinical trial. Team members must plan complex tasks and make critical decisions during this phase–more than at any other point in the trial.

It requires a more streamlined and methodical approach. This includes creating smaller teams hyper-focused on a discrete set of activities while remaining connected to the overall mission and direction set by the clinical study leader. This level of focus leads to more efficient task completion, tighter control of the information, faster decision making and ultimately better outcomes. Of course, one of the areas of focus must be site identification, selection and activation.

Variable 5: Expertise

Expertise, for the purpose of site identification, is the art of taking data from many disparate internal and external sources and turning it into actionable insights, and the science of using that expertise in developing meaningful actionable insights and better outcomes quickly and effectively. This demands access to the right people at the right time to provide thoughtful solutions and approaches.

Variable 6: Engagement

At the end of the day, relationships matter. Trust matters. Networking creates the

opportunity to share knowledge and information, provide opportunities, create connections and build trust. When time is spent to build genuine relationships with the investigational sites, better outcomes lead to more enrollment and higher quality data. It provides context: People share the knowledge and insights they gained, not just meaningless pieces of information. From there, it becomes possible to set goals and define expectations going forward.

Getting There From Here

Most sponsors want to pick the best fit sites for their clinical trial, and they want them to commit to the study quickly and deliver on their goals. They would rather be in a position of knowing versus guessing when it comes to study planning. We can help you get there. We developed this maturity model out of a passion for trying to make the site identification process much more effective.

To that end, WCG is providing advisory services, providing step-by-step guidance and support.

Ready to dramatically speed your clinical trial site identification? Click here to learn about our Site Feasibility & Identification solutions.

Benchmark site performance for your study

Interested to see how the investigators in your current or planned studies match up against the historic performance of all available investigators for the therapeutic area of the study?

Complete the form to schedule a consultation with WCG. We’ll share benchmark data, analyze your results, and share some of the common practices of top performers.